‘First published on Lexology’

Compliance with Related Party Transaction (“RPT”) norms is the need of the hour. It is one of the main pillars of good corporate governance norms in India. It assumes more importance in India due to the presence of various family run businesses. Recent cases before the Ministry of Corporate Affairs and the Securities and Exchange Board of India (“SEBI”) have demonstrated why corporate entities need to be more vigilant and comply with the requirements of the Companies Act 2013 and SEBI with respect to related party transactions.

SEBI has recently in the case of Linde India Limited, one of largest industrial gas company in India, directed it to comply with the norms of materiality thresholds for future related party transactions (RPTs) based on the aggregate value of transactions. This probe was initiated after shareholders had filed a complaint that the aforesaid company did not seek shareholders approval before entering into material related party transactions with its related parties – Praxair India and Line South Asia Services. In another case the Adjudicating Officer, Registrar of Companies Karnataka has imposed a monetary penalty of INR 500,000 on each of the directors of the company, Tablespace Technologies Private Limited and the company.

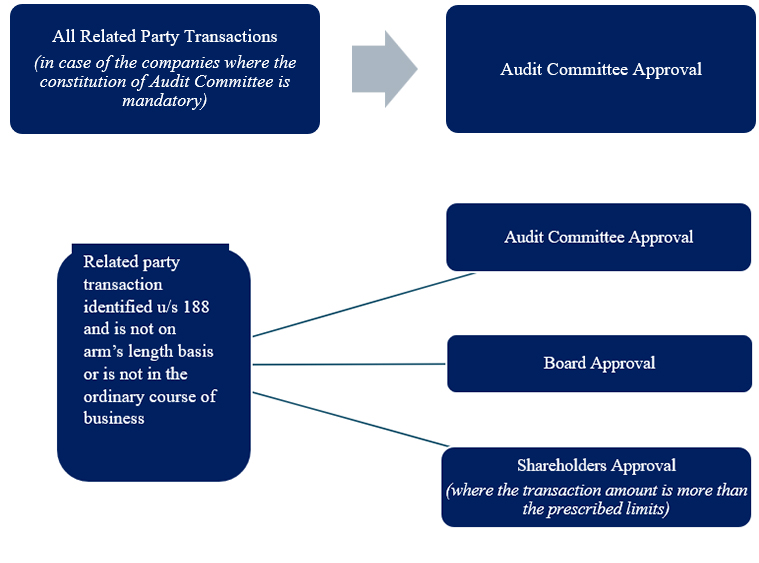

Just to briefly summarize the requirements of RPTs under the Companies Act 2013, the legislation primarily requires, approval of the Audit Committee (in case of the companies where the constitution of Audit Committee is mandatory) for all RPTs, subject to the requirements provided under Section 177 of the Companies Act, 2013. In addition, Board’s approval and Shareholders’ approval in certain prescribed circumstances. These legal requirements can broadly be explained through the following chart:

While this is not a procedural hassle for private limited companies it is difficult in case of public listed companies in view of the wide shareholder base and imminent uncertainties of getting their approval for a proposed business transaction. The Companies Act 2013 also requires complete disclosure of RPTs in annual reports and in financial statements. In addition, SEBI’s LODR Regulations also require listed entities to disclose material RPTs on the occurrence of the event to stock exchanges and to formulate materiality policies.

Despite clarity in law with respect to RPTs, there have been growing instances of breaches. Here are some suggestive measures to prevent such occurrences:

- Strengthening internal control mechanisms. Independent directors, who are part of the Audit Committee, can play a big role in monitoring RPT proposals.

- Timely circulation of Board papers: Board papers should be circulated well in advance of the Board Meeting and extended discussions should take place at the time of consideration of material RPTs.

- Benchmarking: Benchmarking will help in ensuring that the RPTs are taking place on an arms’ length basis.

- Periodic compliance audit: Companies must undertake periodic compliance audits to check whether the RPTs are in compliance with applicable laws.

While the penalty is INR 500,000 for the officers in default for unlisted companies, in case of listed entities such defaulting director or employee are punishable with penalty of INR 25,00,000. The defaulting directors also become disqualified for a period of 5 years. It is therefore prudent for companies to seek good legal counsel while formulating RPT policies, identification of RPT transactions, drafting of documentation, drafting of RPT contracts.

etc. whilst wrongfully claiming to be part of our firm and making false claims and allegations.

etc. whilst wrongfully claiming to be part of our firm and making false claims and allegations.